August ‘25 Market Update

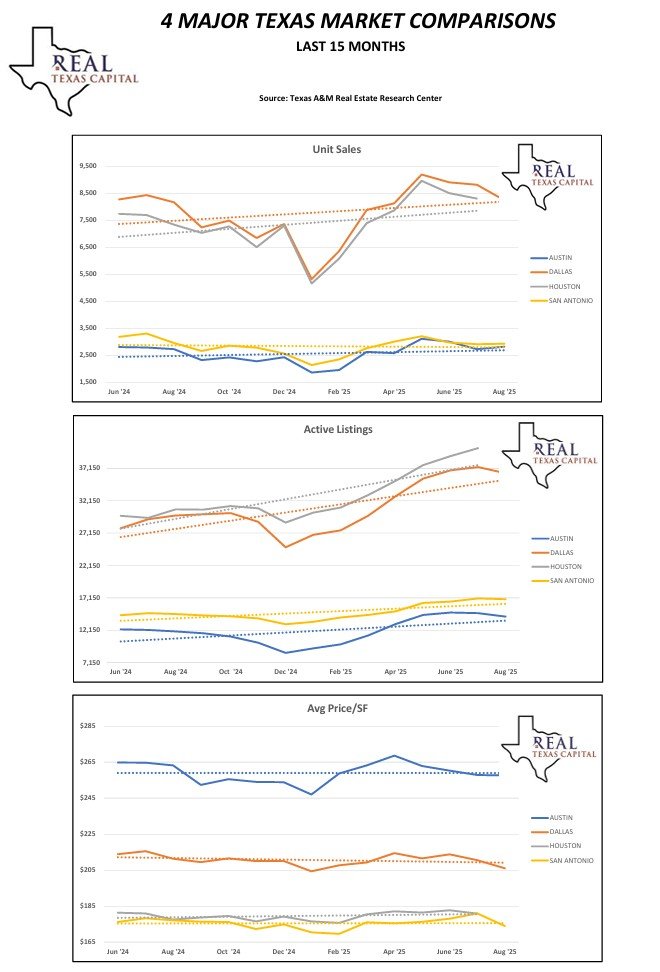

HEADLINE: Mixed Bag! What does this mean exactly? When comparing the previous month’s results to August results for all four of Texas’ major markets (Austin, Dallas, Houston, and San Antonio) there is a new picture emerging. For the first time in a long while, the 4 markets have divergence and less correlation in key housing market data. Take a look:

In previous months, these markets had a high degree of correlation. This new mixed bag could be an anomaly, or due to seasonality, but it also may mean stabilization and possible improvement in the market in coming months. Example: Active Listings and Months of Inventory have been on a continuous trend upward with all 4 markets for last 24 months, as compared to above chart.

Mortgage rates have been trending downward since June, dropping from approximately 6.8% to an average of 6.35% in September—nearly 50 basis points lower than June and 25 below August. This decline could signal a bottoming or stabilization in the housing market, making the winter and spring seasons worth watching for potential strengthening. However, interest rates remain the critical factor. Without a further drop of around 100 basis points in the coming months, this could prove to be a false signal, and continued market softness may persist.

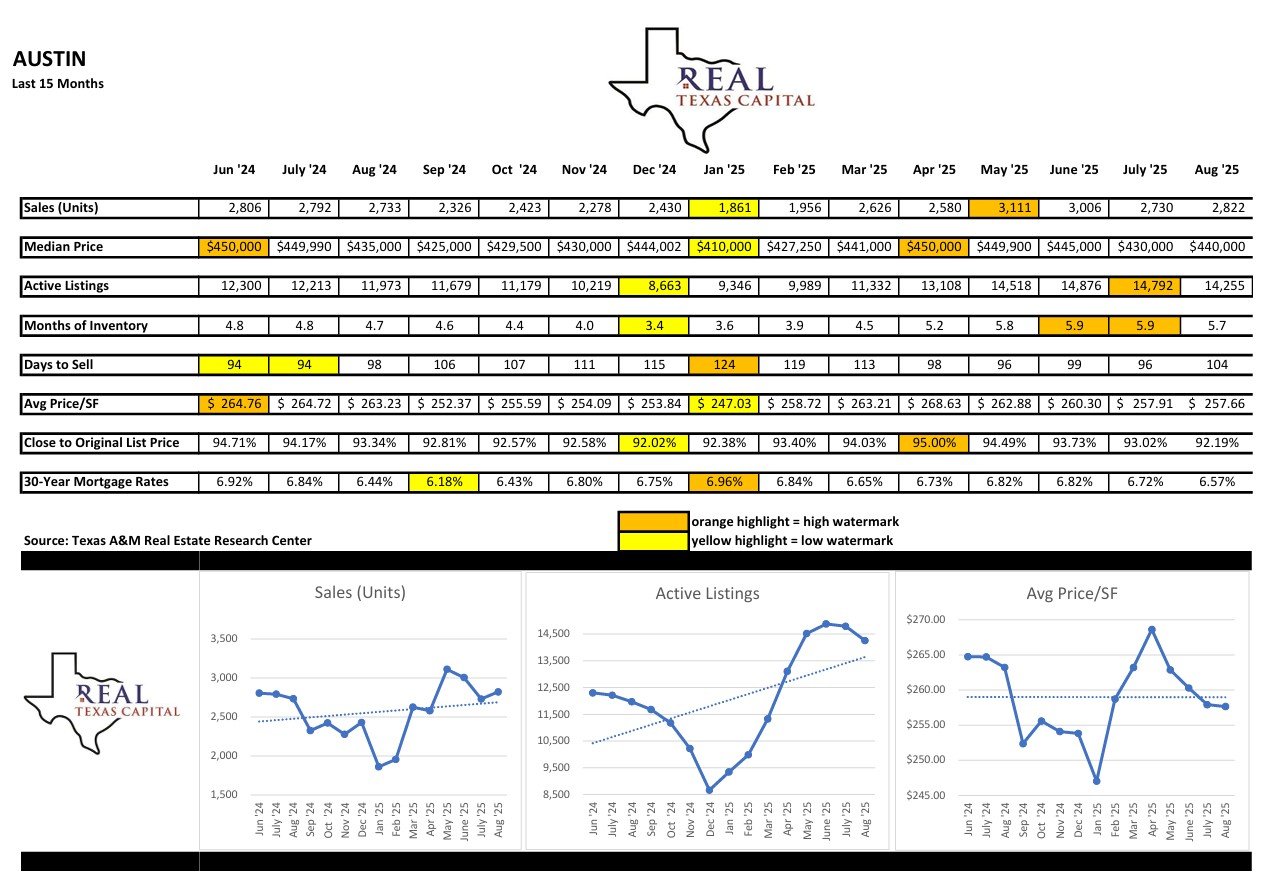

See specific charts below for each of these markets results: