July ‘25 Market Update

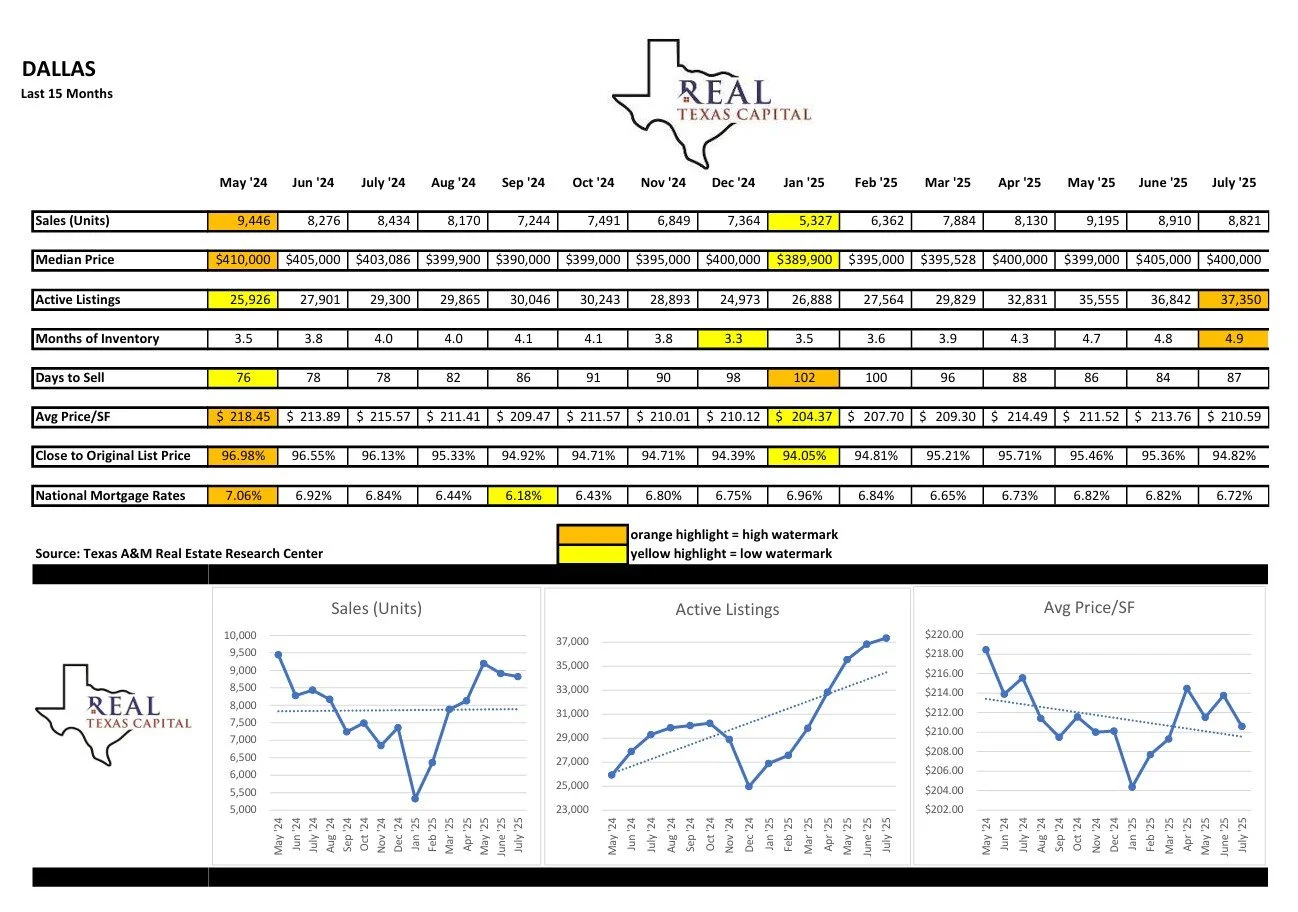

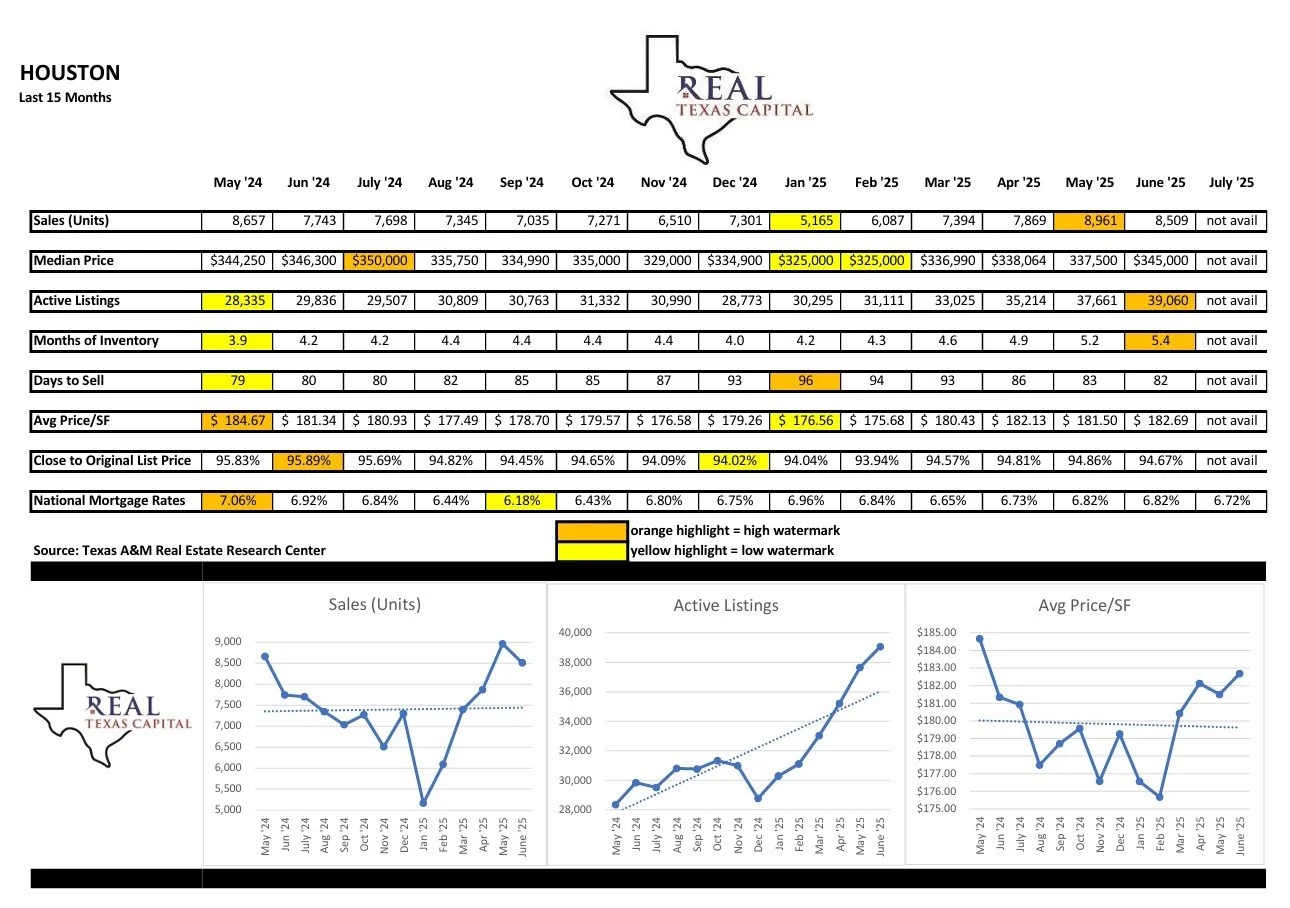

Ending in July 2025, for all four of Texas’ major markets (Austin, Dallas, Houston, and San Antonio): there are record Active Listing and Months of Inventory on market, per Texas A&M Real Estate Research Center. This has been a continuing trend over the last 24 months.

The main culprit for larger inventory levels, in our opinion, is that the market is “locked up”, such that the majority of homeowners have mortgages closer to the 3% level, and the interest rates increased so rapidly to approximately 7%, higher insurance costs, and higher taxes due to values of homes have increased over the last numerous years. All of these factors are leaving homeowners with higher costs of home ownership for a similar home, even if there home has increased in value. Home prices have virtually stopped increasing, and are now decreasing, which is helpful to the market affordability issue for buyers but not enough to entice them into the market.

Until mortgage rates drop significantly, we predict the market to remain sluggish and home pricing pressures to continue. With overall negativity towards housing, the politicians calling for lower rates, lumber and some material prices declining, home prices falling, larger inventories, etc. we believe we are at, or near, the bottom of the market cycle and should see buyers enter the market should mortgage rates decline. Please see the specific industry date for each of the 4 major markets below: